A future for the NHS

By David Fellows

I have no medical training or hospital management experience. I have from time to time had fleeting involvement in health development issues and I have been a hospital patient but I make no claims in writing this except that I am a general client of the NHS. Like millions of others I am simply concerned with the state of play: the lack of GP availability, the quality of some diagnostic services, the management of outpatient services and the speed of hospital referrals.

In exasperation the not-so-wealthy are paying privately for GP services, specialist consultations and surgery. The problem predates COVID. Heavy demands are placed on all health care systems by increasingly sophisticated diagnostics, medical procedures, patients care and medication. Add to this an increasingly elderly population and the country faces the prospect of a colossal financial burden for a less than satisfactory service.

The once acceptable approach of throwing money at the NHS is very obviously not working. Whatever sum is requested and provided is almost immediately decried as insufficient.

The motivation behind the current nurses pay dispute raises a further issue. The demands made are potentially destructive of the NHS, public services in general and the economy. This raises the question as to whether nurses leaders are actually voicing a profound dissatisfaction with the NHS. Has its vastness and complexity come to alienate the very people on whose dedication it depends?

Hitherto the international direction of travel has been towards comprehensive national health services but none has gone so far with integration as the UK. Of course the NHS is not the sole UK provider. Private medicine is available in all fields. The scale of core state provision is around 70% of total medical service expenditure in the UK, similar to core provision in many other developed countries.

But elsewhere the core is often extensively disaggregated. For instance, multiple providers for commissioning (eg not for profit insurance schemes for core provision), hospitals and primary care. Levels of integration may be available. Core services may receive public and private financial contributions and provision may be made for equalising insurance costs of those with poor health. Services for children, unemployed and elderly may be financed by the state. There are many variants including discretionary aspects.

The weakness of the UK system is that the core is massively integrated and almost entirely state driven. The UK has broad geographic and localised divisions of the service but this does not overcome the fact that the centre has overarching responsibility and control. Government is commonly accepted as responsible in all respects. Complaints ultimately rest with Government, shortcomings usually blamed by officials and the media on lack of funds.

With respect to core provision the state is singly charged with operational responsibility for contributing vision, strategy, management, procurement, facilities, personnel, training , medical record development and patient communication. Personal dedication and compassion are valued but the organisational architecture is deficient in drivers for efficiency, innovation and flexibility of reward.

A state with more limited responsibility for delivery obtains a better vantage point from which services can be judged and structural refinements made. Where ultimate operational responsibility is distributed there are more active voices to explain the difficult issues that beset service delivery, more partnering choice for providers and more provider choice for patients.

The bait noire in this alternative universe is the US health system. It is becoming more comprehensive but remains unsatisfactory by the standards of many developed countries and is far too expensive. It is not the starting point for any new health provision model. Other developed countries offer more varied systems as Federico’s review of OECD countries[1] demonstrates.

Frederico is an advocate of progress by marginal refinement for health service development. I suggest this precept that should be readily embraced. The NHS is too exposed to cope with promises of major reform.

My proposal, therefore, is for the Government to affirm the benefits of a more diversely operated health service having both public and private sector counterparts with common regulatory and performance oversight. Where appropriate, public and private sector providers could share facilities perhaps with initial cost borne by the private counterpart and medical expertise could be shared too. Collaboration could also be relevant in the development of management and medical information systems. Private hospitals could qualify as teaching hospitals. It would be a gradual evolution.

The initiative could commence with a call for proposals covering all aspects of potential development within the themes of evolutionary change, service improvement, learning from diversity and providing the prospect of an affordable outcome to exchequer and citizens. These would become the criteria for success on which progress would depend. This is more specific and extensive than the reference to public service reform and the Integrated Care Board review contained in the Chancellor’s Budget Statement.

The outcome could embrace a variety of organisational arrangements. Taxation aspects may require phasing in to avoid any initial net cost to the exchequer. Ultimately there would be a reduction of cost and demand on public provision.

The development process could add significantly to the UK’s innovatory record in the fields of medical service delivery, information and medical technology. Opponents would charge the Government with developing a two tier health service but this would be difficult to sustain given the proposed criteria for pursuing the development.

The public can see the cracks widening and know that the solution is not just more state funding. Any Government that had the courage to tackle the problem honestly and openly could be met with sighs of relief, particularly if the approach was subtle, gradual and sensitive to the dedication of NHS personnel. There are always reasons to postpone a difficult journey but surely the time has arrived.

David Fellows worked extensively in UK local government, was a leader in the use of digital communication in UK public service and became President of the Society of Municipal Treasurers. He was subsequently an advisor on local government reform in the UK Cabinet Office and an international advisor to the South African National Treasury. He is a director of PFMConnect, a public financial management consultancy, and a regular commentator on public financial management issues at home and abroad.

[1] Comparative Health Systems – A new Framework by Federico Toth, Cambridge University Press

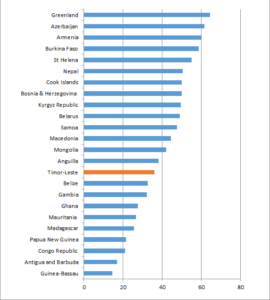

Download a pdf version of Figure 2

Download a pdf version of Figure 2