By David Fellows and John Leonardo

Media reports on Public Private Partnerships (PPPs) for the first half of the current year reveal both opportunities and confusion in the public sector about the use of this method of public service provision. Here we seek to explore the benefits and challenges of these arrangements and identify key questions that should be considered by decision-takers.

What is PPP?

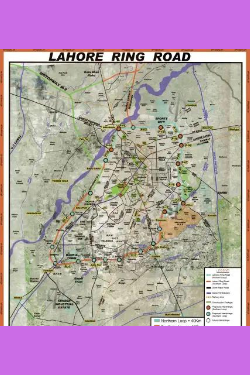

PPP is a form of service delivery where private contractors are recruited by public sector clients to provide services while incurring the necessary capital costs ostensibly at their own risk. The specification of extensive service detail by clients and attempts by contractors to mitigate risk in respect of major capital investments on which returns are generated over long contractual periods result in extensive documentation covering a welter of issues. A health centre or even a school would be too small an item on its own to warrant the development of such a complex format, therefore, such services are usually wrapped into programmes of multiple provisions. Railways, roads, airports and power stations offer prime opportunities for this approach.

The Public Service Benefits of PPP

The PPP model can offer new insights and innovative approaches to public service delivery through contractors’ specialist knowledge and experience. For the public sector the PPP model also removes the challenge of obtaining skilled personnel to undertake design, construction and managerial tasks, eliminates the risk of budget overruns and avoids the state’s need to raise loans to defray capital costs. The latter, in turn, restricts the state’s overall debt burden and this can be of considerable benefit to countries that face serious difficulties in raising loans by conventional means or have agreed debt ceilings that they would otherwise breach. In some cases PPP may offer the only way that services can be provided.

The Transfer of Risk

PPP is not the only way, however, that private sector capacity can be accessed by the public sector. In many countries private contractors are engaged in the design, construction and operation of state-owned facilities through more conventional works and service contracts. The major innovation offered by the PPP model is the bundling together of capital funding, design, construction and operational services. The consequent transfer of risk from public to private sector is therefore regarded as its defining characteristic.

The scale of the services involved, the performance measures stipulated, the performance-linked payment regimes, the penalties stipulated for poor performance, the responsiblities for budget overruns, the size of the initial investment, and the lengthy contractual periods required to meet the necessary return, do indeed provide a formidable nexus of risk for contractors.

As a result, contractors seek to mitigate such risk both by charging a premium for risk assumption and by introducing a wide range of obligations on the public service client that help to secure the contract’s cost base and revenue stream. In simple terms, this is often achieved by specifying service demand levels and operational circumstances within narrow margins. The client is then required to offer restitution for variations outside the stated parameters. This risk reversal clearly serves to diminish the public sector benefits of the PPP vehicle as the client both pays for the risk transfer and pays if the mitigation criteria are breached.

The Consequences of Risk Reversal

The PPP model may assist in the containment of public debt levels but this tends to be overridden by risk reversal and some are beginning to argue that excessive risk diminution should require the basic capital investment to be scored as borrowing against the client state’s capital account. In addition, the market’s view of the client’s credit worthiness is beginning to take into account the PPP deals to which it is committed.

PPP Decision Criteria

The issues raised in recent media reports (see extracts in the Appendix taken from PFMConnect’s Public Private Partnership (PPP) Board on Pinterest ) centre around the opportunities and challenges offered by the PPP model as discussed above although they are not always explained in these terms. The questions arising are mostly for the public sector:

(i) Does the service need to be provided by the public sector or can it be provided by the private sector on its own initiative given a more conducive regulatory environment?

(ii) If the public sector needs to subsidise services for certain sections of the population can those services be provided by the private sector on a commercial basis to the public at large with public sector institutions buying in service provision for people in designated categories or by providing income support for such people leaving them to buy necessary services without any direct linkage between state and service provider?

(iii) As an alternative, should the public sector fund capital investment and buy in design, construction and operational services as necessary depending on its skill base and the nature of service provision and is this feasible in given circumstances?

(iv) Is it reasonable in the given circumstances to assume that long-term service provision can be contracted for without the expectation of substantial changes in service needs and delivery requirements (ie a basic requirement for the PPP model)?

(v) Can the costs and other conditions of a particular PPP contract be justified in terms of need/benefit, cost and priority? Note: in making this assessment it may be worth comparing the PPP costs and risks for the public sector with the costs and risks of the more conventional approach in (iii) above. It may be seen that in many cases that the PPP option may be more expensive than a more conventional approach although the feasibility of the alternative should also be considered.

(vi) If a PPP contract is seen as an essential requirement does the contract contain appropriate termination and variation clauses; has the client reviewed experience elsewhere for similar services under similar contractual arrangements and drawn the necessary lessons from the review; has an appropriate cost-benefit analysis (including risk assessment) of the scheme been completed and fully considered at an appropriate political level; has a benefits realisation strategy been prepared; and has the available advice from recognised authorities been considered on the subjects of procurement arrangements and contractual provisions ?

Conclusion

Most states make extensive use of private sector services in their array of delivery mechanisms. The issue here is not whether private sector contractors should be employed to provide public services but the applicability of the PPP model for this purpose.

It is persuasively argued that the PPP model can bring innovation to public service delivery and facilitate developments that could not be funded in others ways. Importantly, risk may be transferred to private contractors at a price that yields benefit to both parties, although risk transfer may be undermined in negotiation by contractors daunted by its scale and potential ramifications.

The problem of risk transfer, the complexity inherent in PPP negotiations, the difficulty of assuaging public anxieties once expressed and the record of PPP contracts that have been let unwisely must alert public authorities to the need for caution with this model. It is suggested that at the outset of every new proposal clients should ask themselves whether this really is an acceptable way forward and if so whether there is good reason to believe a reasonable deal can be struck to the benefit and satisfaction of both parties. Sometimes the answer should be no.

APPENDIX

Some Recent Media Coverage of PPP (see PFMConnect’s PPP Board on Pinterest)

Some of the Pins that illustrate these issues are, as follows:

USA Transportation Secretaries says private funding isn’t the sole answer – January17

In January the Skift Daily News Letter reported on the commitment of the new USA Administration to PPP infrastructure developments. It referred to the nominee for transportation secretary, Elaine Chao, having said at her Senate confirmation hearing that she wanted to “unleash the potential for private investment” although it reminded readers that she also said that infrastructure plans would include direct federal spending as well.

Skift implied that this latter point chimed with the sentiments of outgoing Transportation Secretary Anthony Foxx who had cautioned prior to his departure that public-private partnerships were useful but could only address about 10 to 20 percent of America’s transportation deficit and that the USA was “still going to need a fair amount of public funding”.

The Skift commented that roadway PPPs typically rely on revenue from tolls or sales taxes dedicated to that purpose to provide investors with a profit and that such projects have had a mixed record in the U.S. Several private toll roads have gone bankrupt, but express toll lanes on major highways constructed in part with private capital have had more success.

The public sector can’t deliver the new urban agenda alone – Feb17

When New York City decided to offer public Wi-Fi kiosks on city streets, it turned to Sidewalk Labs, an Alphabet company. Sidewalk Labs will absorb the cost with revenue from digital advertising and data collection from users.

This kind of partnership will be key to implementing the United Nations’ suite of new agreements to improve life in cities around the world, according to a new report from the World Economic Forum entitled ‘Harness Public-Private Cooperation to Deliver the New Urban Agenda’. The report calls for governments to set up business-friendly systems with clear guidelines for how the private sector can engage with the public sector in a transparent manner that fosters trust and mutual cooperation.

The USA needs a federal centre of expertise to equip the public sector to make PPPs – March17

The American Prospect referred to a report by the new Economic Policy Institute dealing with public-private partnerships. The report commented that design and construction have long been placed with the private sector under traditional contractual arrangements. In contrast to this, under a PPP for major roadworks the private company gets a percentage of a revenue stream, such as a toll or payments based on performance incentives, such as keeping a road well-maintained.

North Carolina agreed to a “non-compete” clause in the PPP contract for a toll road. This required the State to pay a penalty if officials moved to improve transit or nearby roads so some people could avoid paying the tolls. The same company undertook a PPP contract to provide a toll road in Indiana that ran into difficulties and filed for bankruptcy. The report commented that “The politicians behind PPPs are often close allies or financial beneficiaries of a project’s private promoters”.

The report advocated that the federal government should take the lead in amassing the necessary expertise for structuring public-private partnership contracts to the benefits of federal, state and local governments. It notes that such a proposal has been mooted by the federal Department of Transportation but was skeptical about the prospects for its imminent implementation.

Firehouse Broadcasting, Indiana – July 17

Firehouse Broadcasting reported on the dissolution of a PPP valued at $325m for the provision of a highway over a period of 35 years. Senate Appropriations Committee Chairman Kenley criticized the state for focusing too much on low bids and not enough on the background and credibility of the bidders. He suggested that signs that the company could not financially complete the project existed before the state agreed to work with them.

The state now plans to take over the project entirely. Governor Holcomb’s fiscal team says that because the state’s credit is better than the developer’s, costs for the project will actually decrease when the state takes out bonds for the project, possibly saving taxpayers around 30 million dollars.

PPP in the Philippines suffers delays amid lack of continuity policy – Feb 17

The Manila Times quotes the Fitch Groups’ BMI Think Tank as commenting that ‘The Philippines has one of the most robust PPP frameworks in Asia but projects continue to suffer delays … of the 56 PPP projects launched since 2010, only four are complete as of January 2017, while many others have been repeatedly delayed due to financing, land acquisition and contract negotiations’.

BMI reported Secretary of Finance, Carlos Dominguez, as promising that he would ‘dramatically review the PPP process’.

Scaling up Infrastructure Investment in the Philippines: the Role of PPP – June 17

The Asian Development Bank reported that lack of infrastructure development had held back the economy of the Philippines but reforms in the country’s approach to PPP were now helping to redress the situation. As a result, 11 projects worth P200 billion had been awarded and there was now a pipeline of 40 bankable projects ranging from expressways, airports, seaports, water, urban rail, information technology, and social sector projects (classrooms, hospitals, prisons).

The report recommends that: the stock of development project should now be vetted in line with government priorities; a medium-term financial framework should be adopted as the basis for investment; appraisal processes should be strengthened with PPP and directly financed projects being similarly assessed and selected; risk assessment to be fully embraced and included in VFM analyses; early termination decision process to be reviewed; and the legal framework to be revised to improve the attractiveness of the PPP environment to the private sector.

Philippines Government auctions to be limited to single rebidding – July 17

Business World reported that during a round table the Socioeconomic Planning Secretary of the Philippines, Ernesto M. Pernia, had stated that the Government will do away with multiple rebiddings in an effort to halve the current 30-month procurement process before the project breaks ground.

It is clear from the report that PPP projects had regularly fallen victim to a variety of disputes between competing contractors, between contractors and government and between landowners and government. Courts orders were being sought to enforce delays while disputes were settled, some taking many years.

Challenges in Jaipur High Court to PPP for health centres – May 17

The Times of India reported on high court challenges and ambivalence at state government level concerning the inclusion of substantial numbers of health centres in PPP deals. Challengers have suggested that such arrangements should be made in ‘pilot mode (offering) a chance to learn from the experience’. It was reported that last year the government in Karnataka had stopped PPP deals concerning 52 hospitals finding that the quality of services had not improved substantially although costs borne by government had risen.

In the same month the World Bank Group’s International Finance Corporation reported on the benefits gained by India’s Jharkhand State from PPP investment in hospital pathology and dialysis technology that it had enabled patients to receive medical scans at local facilities with the state bearing the costs for poorer patients.

Big push for private players as India’s Government unveils new metro policy – August 17

BloombergQuint reports that India’s Union Cabinet has determined that private participation either for complete provision of metro rail or for some unbundled components (like automatic fare collection, operation & maintenance of services) will form an essential requirement for all metro rail projects seeking central financial assistance. Project evaluation will be based on the economic rate of return for large projects taking into account the wider social value generated.

The new policy also mandates evaluation of various modes of mass transit like the bus rapid transport system, light rail transit and tramways.

Guidance on PPP contractual provisions, 2017 edition – June17

The World Bank has published an updated version of its Guidance on PPP Contractual Provisions in response to an encouraging reception to its initial guidance issued two years ago. Announcing the new edition the World Bank acknowledged that the complexity of public-private partnership (PPP) transactions often involves considerable time and expense in preparing and finalising a PPP contracts. It admitted that the development of complete PPP contracts on an international basis was unrealistic but there was merit in focusing on common contractual provisions.