Bosnia & Herzegovina Public Financial Management Profile

Introduction

This note presents a series of charts which provide an overview of Bosnia and Herzegovina’s recent public financial management (PFM) performance based on this country’s 2014 Public Expenditure and Financial Accountability (PEFA) assessment. Comparisons are made between Bosnia and Herzegovina’s performance and the performance of the other twenty-three countries that had PEFA assessments published in 2014-2015. All analyses have been prepared using results reported from using the 2011 PEFA methodology.

Overall PFM performance

Individual country PFM performance has been determined by applying the following points scale to reported individual performance indicator (PI) scores as presented in Table 1. No points were allocated to PIs that were not scored because either data was unavailable, a D score was given or the PI was not applicable.

Table 1: PI scoring methodology

|

PEFA PI score |

Points allocated |

|

A |

3 |

|

B+ |

2.5 |

|

B |

2 |

|

C+ |

1.5 |

|

C |

1 |

| D+ |

.5 |

| D |

0 |

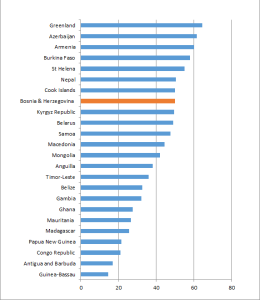

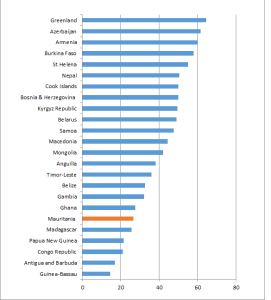

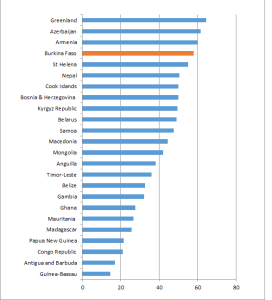

The graph in Figure 1 below shows Bosnia and Herzegovina’s overall score was ranked 8th out of the twenty-four countries.

Figure 1: Aggregate PEFA scores for 24 countries

Details of the distribution of overall country scores across PFM performance categories, as determined by PFMConnect, are presented in Table 2. Bosnia and Herzegovina’s overall score was 50 points.

Table 2: Distribution of country PFM performance levels

| PFM performance | Overall Scores | Number of countries |

| Very strong | 66.37-84 | 0 |

| Strong | 49.57-66.36 | 8 |

| Moderate | 32.77-49.56 | 7 |

| Weak | 15.97-32.76 | 8 |

| Very weak | 0-15.96 | 1 |

| Total | 24 |

Bosnia and Herzegovina’s overall PFM performance is classified as “strong”.

PI performance

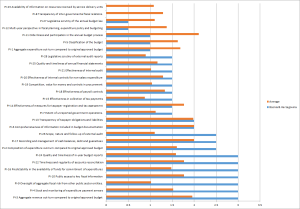

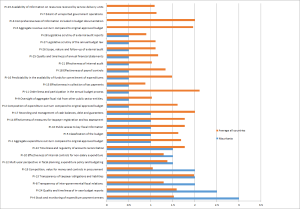

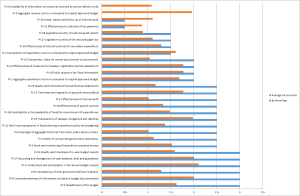

The graph in Figure 2 below shows the scores for Bosnia and Herzegovina’s individual PIs compared with the average score recorded for each PI across the twenty-four PEFA assessments we have studied. Please note that no scores were recorded for the top two indicators in Figure 2 (PI-8 and PI-23) as these indicators were not applicable in the case of Bosnia and Herzegovina.

Figure 2: Bosnia and Herzegovina PI score comparisons

Download a pdf version of Figure 2 here (Bosnia and Herzegovina PIs) to review individual PI scores in more detail.

Twenty-six PIs were assessed. Nineteen PIs had scores above the country average, one PI had a score equal to the country average whilst six PIs had scores below the country average.

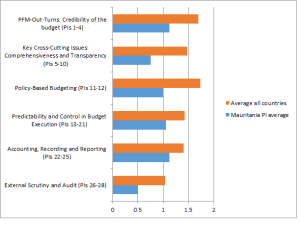

Performance across key PFM activities

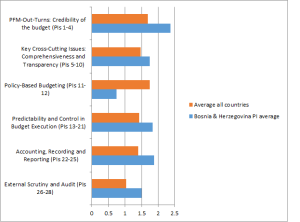

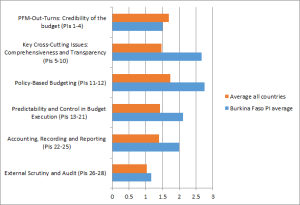

The graph in Figure 3 below shows the average scores for the six key PFM activities compared with the average score recorded for these activities across the twenty-four country PEFA assessments we have studied.

Figure 3: Bosnia and Herzegovina key PFM activity comparisons

Five key PFM activities recorded scores above the country average whilst one activity recorded a score below the country average.

PEFA ASSESSMENT

You can download the 2014 PEFA assessment for Bosnia and Herzegovina here.